Life Organization

Organizing your life means managing your money, your home, and your daily routines in a way that keeps you balanced and in control. Most people struggle because nobody teaches these basics. This guide breaks everything down so you can stay organized without stress or overwhelm.

1. Budgeting for Beginners

A budget is a simple plan for your money. It helps you understand what you have, what you need, and what you can save. Budgeting is not about restriction, it is about clarity and control.

Steps to Start Budgeting

List your income

Include all sources of monthly income so you know your true starting point.

Write down your monthly bills

Rent

Utilities

Phone

Internet

Insurance

Subscriptions

Group your expenses into categories

Housing

Transportation

Food and groceries

Subscriptions and entertainment

Personal spending

Savings and investments

Subtract expenses from income

This shows what you have left, or where you need to adjust.

Adjust until the numbers make sense

Reduce categories that are too high

Increase savings where possible

Make small changes instead of big unrealistic ones

Easy Budgeting Methods

Fifty, thirty, twenty method

Fifty percent needs

Thirty percent wants

Twenty percent savings and debt payments

Zero based budget

Every dollar has a purpose

Income minus expenses equals zero

You assign every dollar to a category

Envelope or category method

Great for people who overspend

You set a limit for each category and stop when it is reached

Tips

Track your spending weekly

Cancel unused subscriptions

Review your budget monthly

Use apps if needed

Mint

EveryDollar

Spreadsheets

Avoid emotional spending

Make room for fun so you do not feel restricted

Budgeting gives you control instead of guessing. It helps you feel stable, confident, and prepared for both expected and unexpected expenses.

2. How to Start Saving

Saving money creates stability, protects you during emergencies, and helps you reach future goals. The amount does not matter at first, the habit does.

Steps to Start

Open a savings account

Choose something separate from your checking to avoid spending it.

Set a simple goal

Fifty, one hundred, or whatever you can realistically commit to.

Set up automatic transfers

Move a small amount into savings once a week or every payday.

Types of Savings

Emergency fund

Covers three to six months of essential bills.

Short term goals

Travel

Holidays

Birthdays

Small purchases

Long term goals

House

Car

Investments

Financial freedom

Tips

Save before you spend

Transfer money to savings as soon as you get paid.

Start small

Even five or ten dollars per week grows over time.

Avoid moving money back into checking

Create a small buffer in checking so you are not tempted to transfer from savings.

Use separate accounts for different goals if it helps

Travel fund

Emergency fund

Personal goals

Financial peace comes from building consistent habits early. Every dollar saved is a step toward independence and stability.

3. Grocery Shopping Basics

Grocery shopping is easier, faster, and cheaper when you have a simple plan.

Before You Go

Check your fridge and pantry

See what you already have to avoid duplicates.

Make a list

Write down exactly what you need for the week.

Plan simple meals

Choose meals with overlapping ingredients to save money.

Set a budget

Know what you can spend before you walk in.

At the Store

Stick to your list

Impulse buys add up fast.

Shop store brands

They usually offer the same quality for less.

Buy produce in season

Seasonal fruits and vegetables taste better and cost less.

Avoid shopping hungry

You will buy more than you need.

Money Saving Tips

Use digital coupons

Most stores offer easy app discounts.

Compare unit prices

Look at the price per ounce or pound to find the best deal.

Buy in bulk when it makes sense

Great for items you use often and that store well.

Planning ahead saves money, reduces stress, and makes grocery shopping feel effortless.

4. How to Keep a Clean Home

A clean home is easier to maintain with small daily habits instead of waiting for a big deep clean.

Daily habits

Make your bed

Wash dishes

Wipe counters

Do a ten minute tidy session

Weekly habits

Laundry

Vacuuming

Bathroom cleaning

Change bedding

Take out trash

Monthly habits

Wipe appliances

Clean windows

Declutter one small area

Check expiration dates in fridge and pantry

Consistency makes your home feel manageable, peaceful, and easy to maintain.

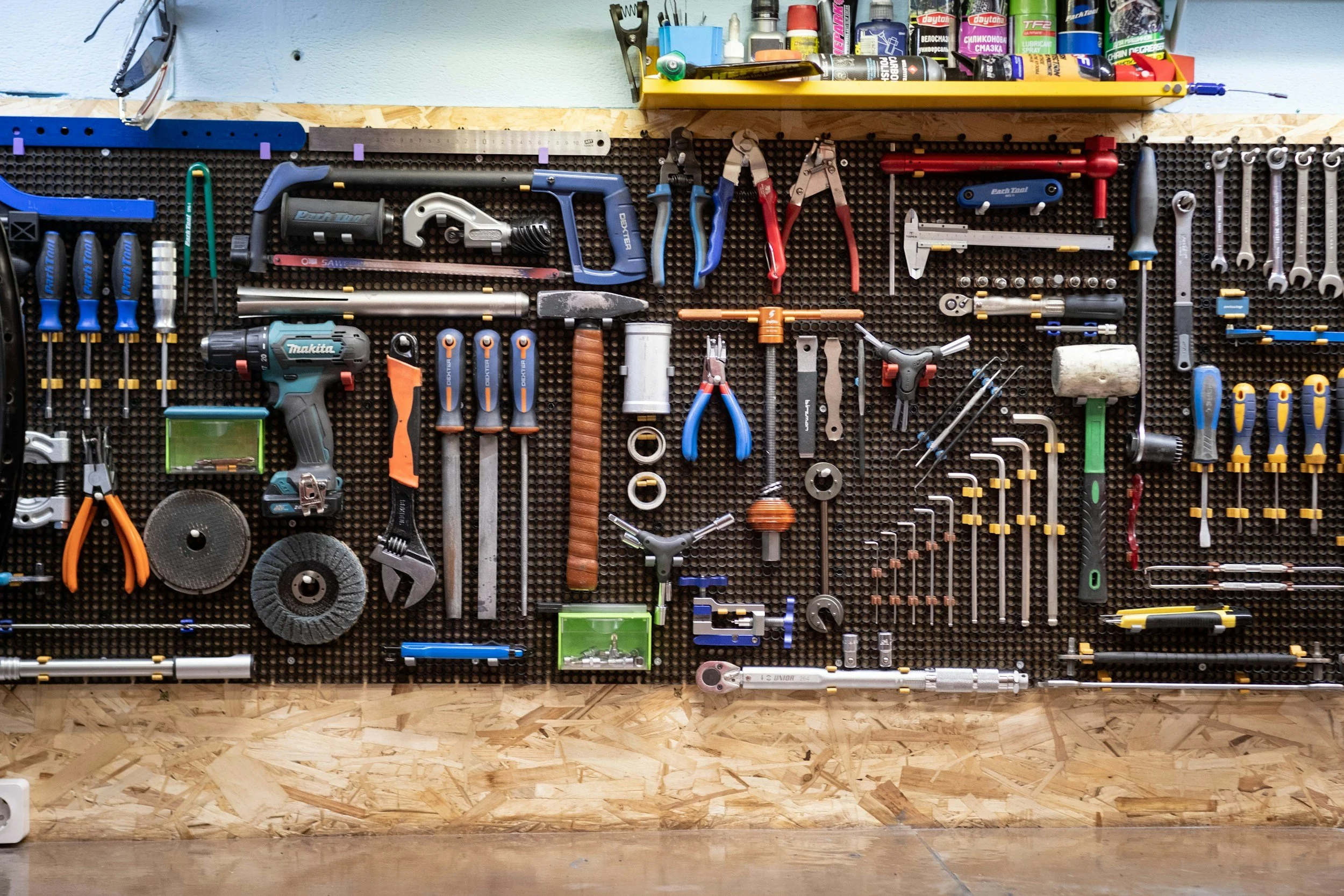

5. Basic Household Maintenance

Maintenance prevents small issues from turning into expensive problems.

Simple tasks

Change air filters

Check smoke detector batteries

Unclog drains early

Clean fridge coils

Check for leaks under sinks

Replace light bulbs when needed

Reset tripped breakers if power goes out

Keep gutters clear if you have them

Seasonal tasks

Winter

Check heating system

Cover outdoor pipes

Seal drafts around windows and doors

Summer

Check air conditioning

Clean fans and vents

Test outdoor hoses and sprinklers

Knowing the basics keeps your home safe, efficient, and easier to manage long term.

6. Digital Life Declutter

Your digital life needs maintenance just like your home. Clearing clutter improves focus and reduces stress.

Declutter your phone

Delete unused apps

Organize photos into albums

Clear old messages

Turn off unnecessary notifications

Remove old screenshots

Update storage settings

Declutter your computer

Organize files into folders

Delete duplicates

Clear the downloads folder

Empty the recycle bin

Back up important documents

Update software when needed

Email organization

Unsubscribe from spam

Create simple folders for sorting

Respond, archive, or delete messages

Use filters to keep important emails visible

Keep your inbox under control weekly

A clean digital space helps your mind stay clear and your workflow run smoother.

Your Next Step in Life Organization

Life becomes easier when your money, home, and routines are simple and organized. When things are in order, you gain mental clarity and daily peace.

Next, explore

Adult life skills

Money and real world finance

Career development

Your Resource Hub is here to guide you step by step as you build a stable, organized, and confident life.