Insurance and Taxes

Insurance protects you.

Taxes keep you compliant.

Both are part of real world adulthood that most people were never properly taught.

This guide explains insurance, tax basics, how to prepare, and what beginners need to know to stay protected and organized.

1. What Is Insurance

Insurance is financial protection. You pay a monthly or yearly premium, and in return, the insurance company helps cover costs when something unexpected happens. It is a safety net that protects you from major financial loss.

What Insurance Does

Protects your money

Covers unexpected events

Gives you peace of mind

Reduces financial risk

Helps you recover faster after emergencies

Insurance does not stop bad things from happening, but it makes those situations much easier to manage financially.

Common Types of Insurance

Health insurance

Helps cover doctor visits, medications, emergencies, surgeries.

Auto insurance

Protects you if you get into a car accident or if your car is damaged.

Renters insurance

Covers your belongings in an apartment and protects you if someone gets hurt in your space.

Homeowners insurance

Covers the structure of your home and your belongings.

Life insurance

Provides financial support to your family if you pass away.

Business insurance

Protects your company, equipment, liability, and operations.

Pet insurance

Helps with vet bills, surgeries, and emergencies for pets.

Why Insurance Matters

Without insurance, one accident, medical emergency, or unexpected event can lead to extremely high bills. Insurance exists to protect you from losing your savings, going into debt, or facing financial hardship when life surprises you.

Insurance is not just a bill to pay. It is a financial shield that protects your stability, your peace, and your future.

2. How to Shop for Insurance

Shopping for insurance is not about finding the cheapest price. It is about finding the best protection for your situation. The right policy keeps you covered, supported, and financially safe.

Steps to Shop Smart

1. Know what coverage you need

Different situations require different levels of protection. Decide what risks matter most in your life.

2. Get quotes from multiple companies

Rates can vary a lot between insurers. Always compare.

3. Compare more than price

Look at

coverage limits

deductibles

monthly or yearly premiums

extras and exclusions

4. Check reviews and customer service

A low price means nothing if the company is slow or difficult when you need help.

5. Ask about discounts

You may qualify for

bundling discounts

safe driver discounts

continuous coverage discounts

good student discounts

home security discounts

loyalty rewards

Where to Shop

Direct insurers

Companies you can contact directly.

Geico

State Farm

Progressive

Allstate

Liberty Mutual

USAA, if eligible

Online comparison tools

Tools that show multiple quotes at once.

Policygenius

The Zebra

NerdWallet

Important Tips

Do not choose the cheapest option if the coverage is weak.

Ask detailed questions about what is and is not covered.

Avoid high deductibles if you cannot comfortably pay them.

Review your policy every year or when big life changes happen.

Why This Matters

Strong coverage protects you when you need it most. A slightly higher premium is worth it if it prevents you from paying thousands out of pocket.

Smart insurance shopping gives you confidence, stability, and real financial protection.

3. Deductible versus Premium Explained

These two terms confuse most people, but once you understand them, choosing insurance becomes easier.

Premium

This is the amount you pay monthly or yearly for your insurance policy.

Lower premium means

you pay less each month

you usually pay more out of pocket when something happens

Higher premium means

you pay more each month

you pay less when something happens

Deductible

This is the amount you pay out of pocket when a claim occurs before your insurance company pays the rest.

Low deductible

higher premium

less money out of pocket during an emergency

High deductible

lower premium

more money out of pocket during an emergency

Simple Rule

If you want lower monthly bills, choose a higher deductible.

If you want lower emergency costs, choose a lower deductible.

Understanding this balance helps you choose a policy that fits your budget and your comfort level.

Personally, I always recommend a lower deductible because you never know when an emergency can occur. It is always better to budget for the lower deductible to have a smaller out of pocket expense during an emergency. This way you can have more money on hand for other emergency expenses.

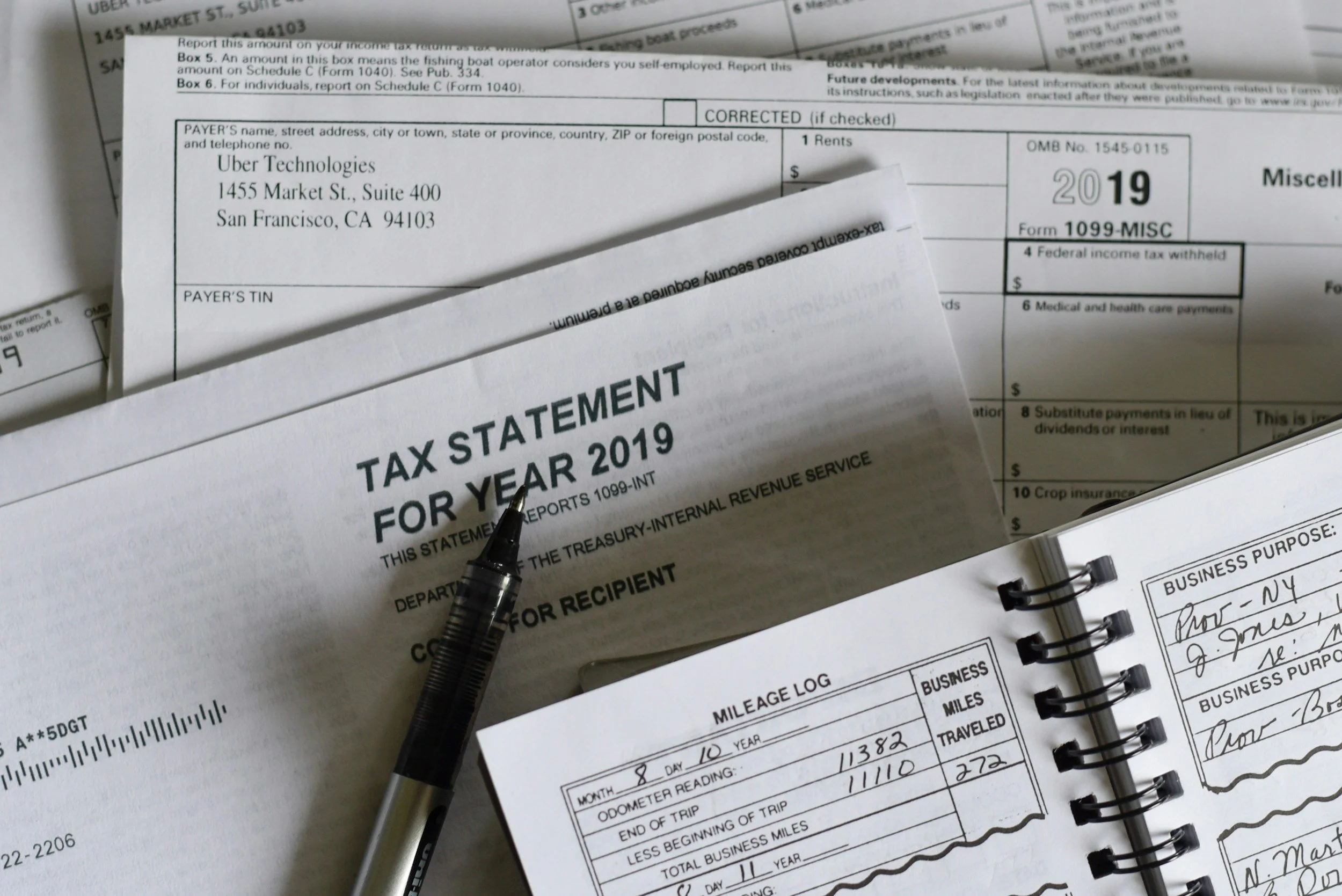

4. How to Organize for Tax Season

Staying organized for tax season saves you stress, money, and mistakes. Good organization also helps you catch deductions you might otherwise miss.

What to Keep

Income statements

W2

1099

Pay stubs

Any documents showing money earned

Expense records

Receipts

Invoices

Mileage logs

Business related subscriptions

Bank and financial documents

Bank statements

Credit card statements

Loan documents

Business paperwork

LLC documents

EIN confirmation

Business licenses

Any contracts or agreements

How to Stay Organized

Create one system and use it all year.

Use a folder for each category

Track income and expenses monthly

Save all receipts digitally

Use a simple spreadsheet or bookkeeping software

Keep business and personal finances separate

Tools That Help

QuickBooks

Wave (free)

Google Drive

Dropbox

Notion or spreadsheets

Digital systems make it easier to search, upload, and sort documents without losing anything.

Tips

Do not wait until April

Organize throughout the year

Review your documents monthly

Keep everything in one place

Save both digital and physical copies when possible

Being prepared makes filing faster, easier, and less stressful. It also reduces your chance of errors and helps you get the deductions you are entitled to.

5. What Is a Write Off

A write off, also called a deduction, is an expense you subtract from your taxable income. This lowers the amount of money the government taxes, which can reduce what you owe.

What This Means

If you spend money on something necessary for work or business, you may be able to deduct it.

Write offs do not give you money back. They simply reduce your taxable income so you owe less.

Common Write Offs

Office supplies

Software and apps

Internet bill

Phone bill (business portion)

Courses and education

Marketing and ads

Work equipment

Subscriptions and tools

Mileage or travel for work

Home office portion (if applicable)

Simple Rule

If it helps you work, operate, or earn money, it may qualify as a write off.

Keep receipts.

Track expenses monthly.

Speak to a tax professional if you are unsure what applies to you.

Write offs are one of the easiest ways to legally lower your taxes when used correctly.

6. Beginner Tax Tips

These simple habits help you avoid mistakes, reduce stress, and stay compliant with the IRS.

Pay Attention to Deadlines

Mark all tax deadlines on your calendar

Set reminders a week before each deadline

Avoid last minute filing to reduce errors

Keep Everything Documented

Save and organize

Receipts

Invoices

Bank and credit card statements

Mileage logs

Any proof of income or expenses

Good documentation protects you during audits and helps you claim all eligible deductions.

Do Not Mix Personal and Business

If you have a business

Use a separate bank account

Use a dedicated card for expenses

Mixing finances can cause IRS issues and make bookkeeping messy.

File Even If You Cannot Pay

Always file your return

The penalty for not filing is worse than the penalty for paying late

You can set up a payment plan with the IRS

Filing on time protects you from unnecessary penalties.

Use Software If Needed

TurboTax

H and R Block

TaxAct

Cash App Taxes (free)

These tools guide you step by step and reduce errors.

Ask for Help

If you are confused, hire a tax preparer or accountant

They help maximize deductions and prevent costly mistakes

Professional help is especially useful for businesses

Being organized, proactive, and informed keeps tax season simple and stress free.

Your Next Step in Insurance and Taxes

Insurance protects your life.

Taxes protect your future.

When you understand the basics, you feel more confident, prepared, and financially stable.

Next, explore

Credit and loans

Money management

Real world skills

Your Resource Hub will help you stay informed and in control every step of the way.